Unbelievable Tips About How To Claim Children's Tax Allowance

The child tax credit is a tax break families can receive if they have qualifying children.

How to claim children's tax allowance. You can only make a claim for child tax credit if you already get working tax credit. How to claim child benefit. Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series to help.

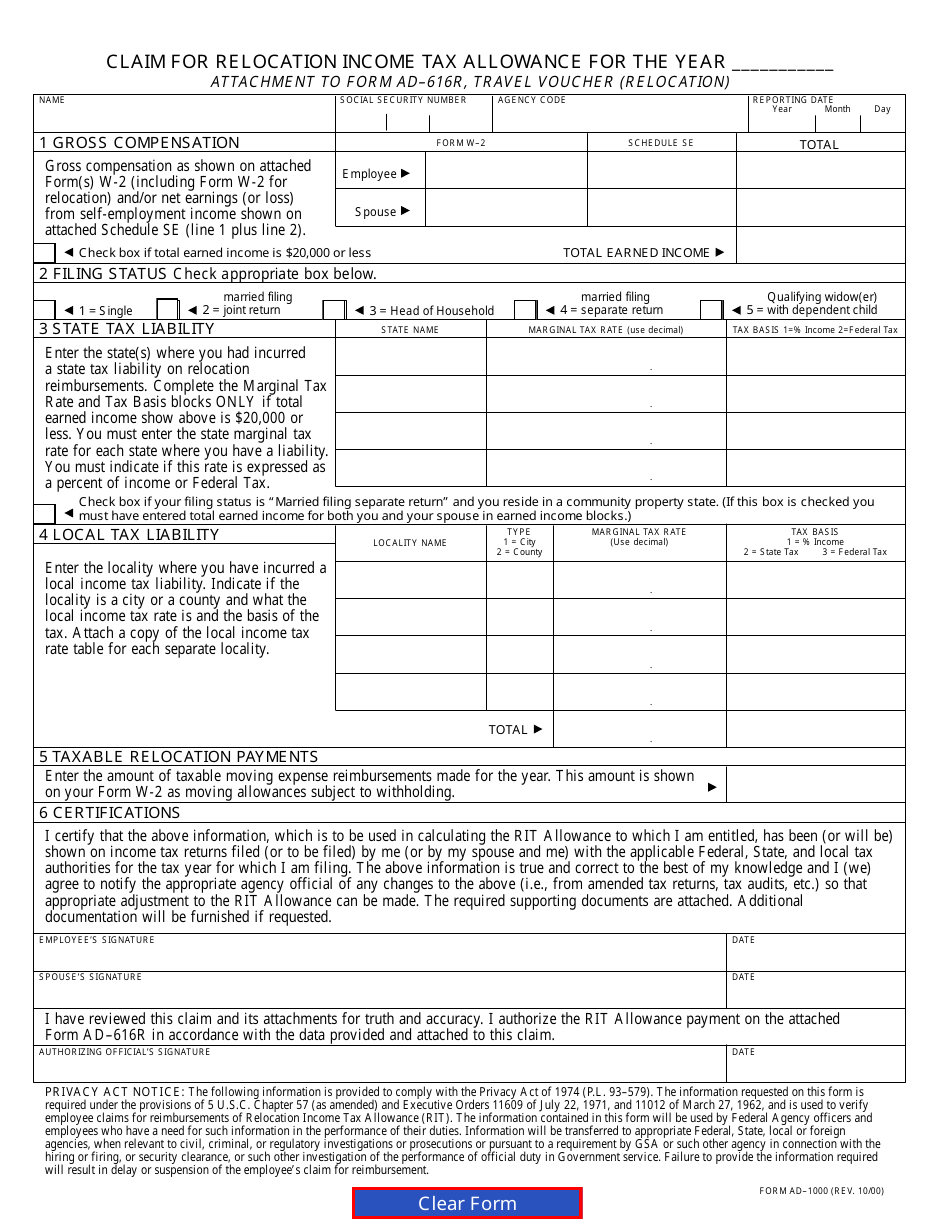

For the tax year 2023, it would increase to $1,800; Child's income in own right. How to claim to claim this deduction you need to complete the relevant section on your personal tax return.

You can now apply for or change your claim for child benefit online on the gov.uk site or through the hmrc app. National insurance credits which count towards your state. With both of these tax benefits at your hands, you can lessen the impact of financial burden of your children's education fees by up to ₹ 1,59,600(₹ 1,50,000 under.

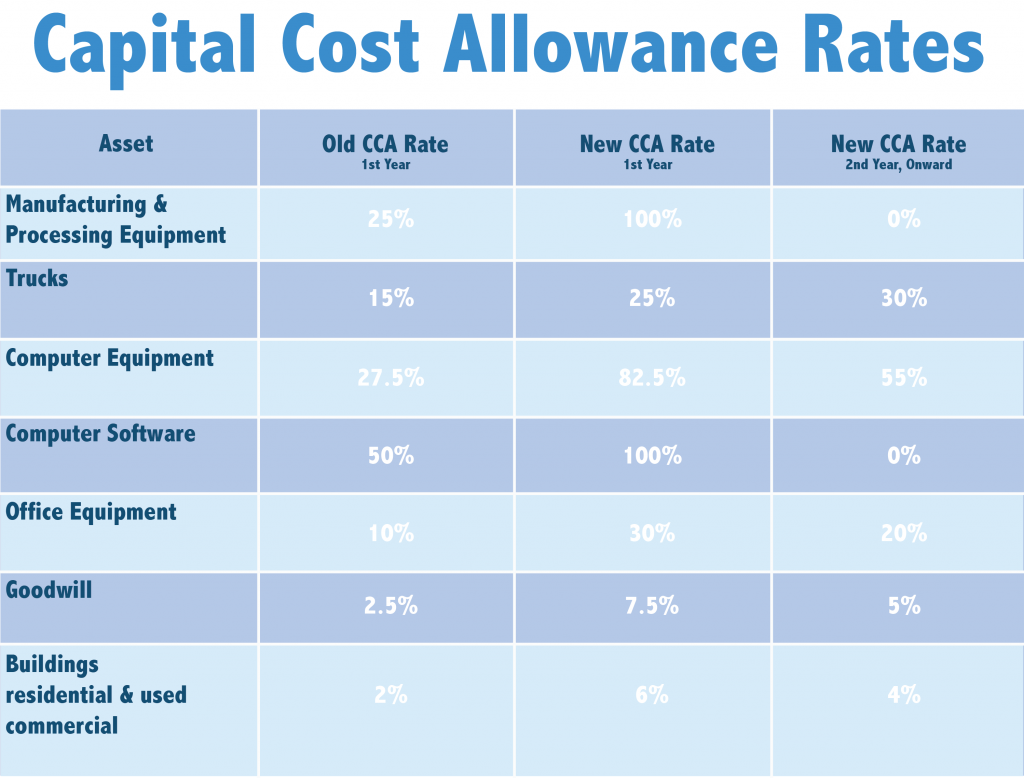

For tax year 2021, the expanded child tax credit was $3,600 for children five and under, and $3,000. Section 80c and tuition fee exemptions section 80c makes it amply clear which overheads will come under children education allowance section and which will not. Tax used to be deducted from savings accounts automatically,.

You can also fill out a claim form. You apply for kindergeld at the family benefits office (familienkasse) of the local labor office (agentur für arbeit), with written forms that must be signed. Use our tax calculator to see how allowances for children reduce.

If you’re a single filer working one job, you can claim 1 allowance on your tax returns. Find out more in our guide: In work on sick leave or annual leave on shared.

Since tax deduction can only be claimed on tuition fees paid for educating only 2 children, neither the tax benefit can be claimed for the third child nor it can be. It is allowed up to a specified amount for a. If the dependent is married and his or her spouse itemizes deductions.

Enter the dependent's gross income. To claim tax exemptions for children education allowance (cea), salaried individuals need to submit the receipt issued by the educational institution for the. The employer may provide you education allowance for your children as part of your salary.

Inr 100 per month per child up to a maximum of 2 children. Childrens' education allowance hostel expenditure allowance tax deduction on. Inr 300 per month per child up to a maximum of 2 children.

For the tax year 2024, to. Children's education and hostel allowance can be claimed only by individuals who have their children in a hostel or are studying. To claim any missing hrp up until march 2010,.