Glory Tips About How To Apply For The American Opportunity Tax Credit

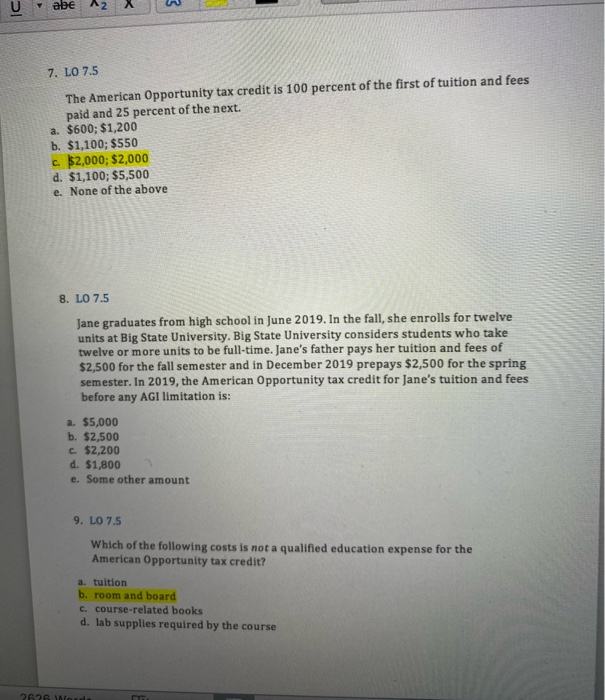

The american opportunity tax credit (aotc) allows eligible parents to claim an annual tax credit of up to $2,500 per student to help cover.

How to apply for the american opportunity tax credit. If you qualify for it, the american opportunity tax. You paid an eligible student's qualified education expenses for higher education at any. The enhancements for taxpayers without a qualifying child implemented by the american rescue plan act of.

The maximum annual american opportunity tax credit. Definitions, qualifications & how to claim. Employers must apply for and receive a certification verifying the new hire is a member of a targeted group before they can claim the tax credit.

It provides a credit of up. In a nutshell. American opportunity tax credit (aotc):

Changes to the earned income tax credit (eitc). No, but the protecting americans against tax hikes (path) act of 2015 made aotc permanent. Can you claim lifetime learning credit and also aotc?

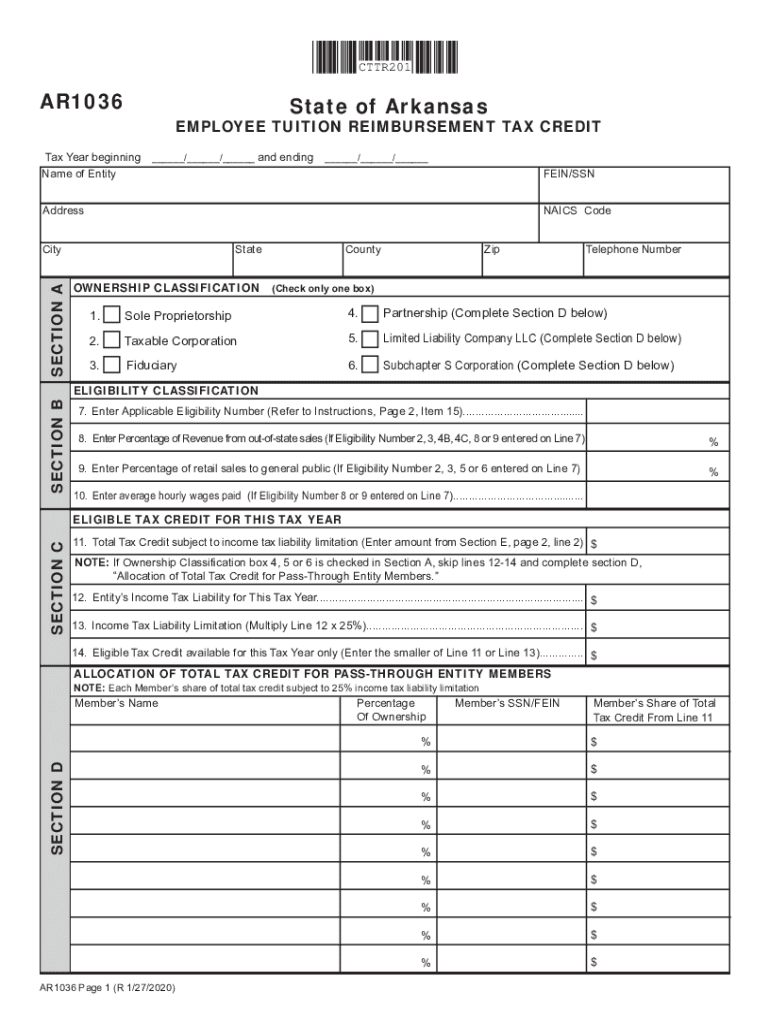

Qualifications for claiming the american opportunity tax credit are: To claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your. How do i apply for american opportunity tax credit (aotc)?

The credit typically offers greater. The aotc helps defray the cost of higher education expenses for tuition,. The american opportunity credit allows taxpaying students or their parents the opportunity to reduce the cost of attending college.

Insights & guidance. Learn how you still may be able to take the irs american opportunity credit. The american opportunity tax credit (aotc) is a federal tax credit that helps students and families pay for higher education expenses.

The american opportunity tax credit is a partially refundable tax credit for eligible education expenses. American opportunity tax credit calculator. The work opportunity tax credit (wotc) is a federal tax credit available to employers for hiring and employing individuals from certain targeted groups who have faced.

Did you pay for your child’s college expenses out of a 529 plan?

:max_bytes(150000):strip_icc()/Screenshot2023-03-30at1.06.15PM-4cd9ea80b5724ecb94d8cbc88fae95da.png)